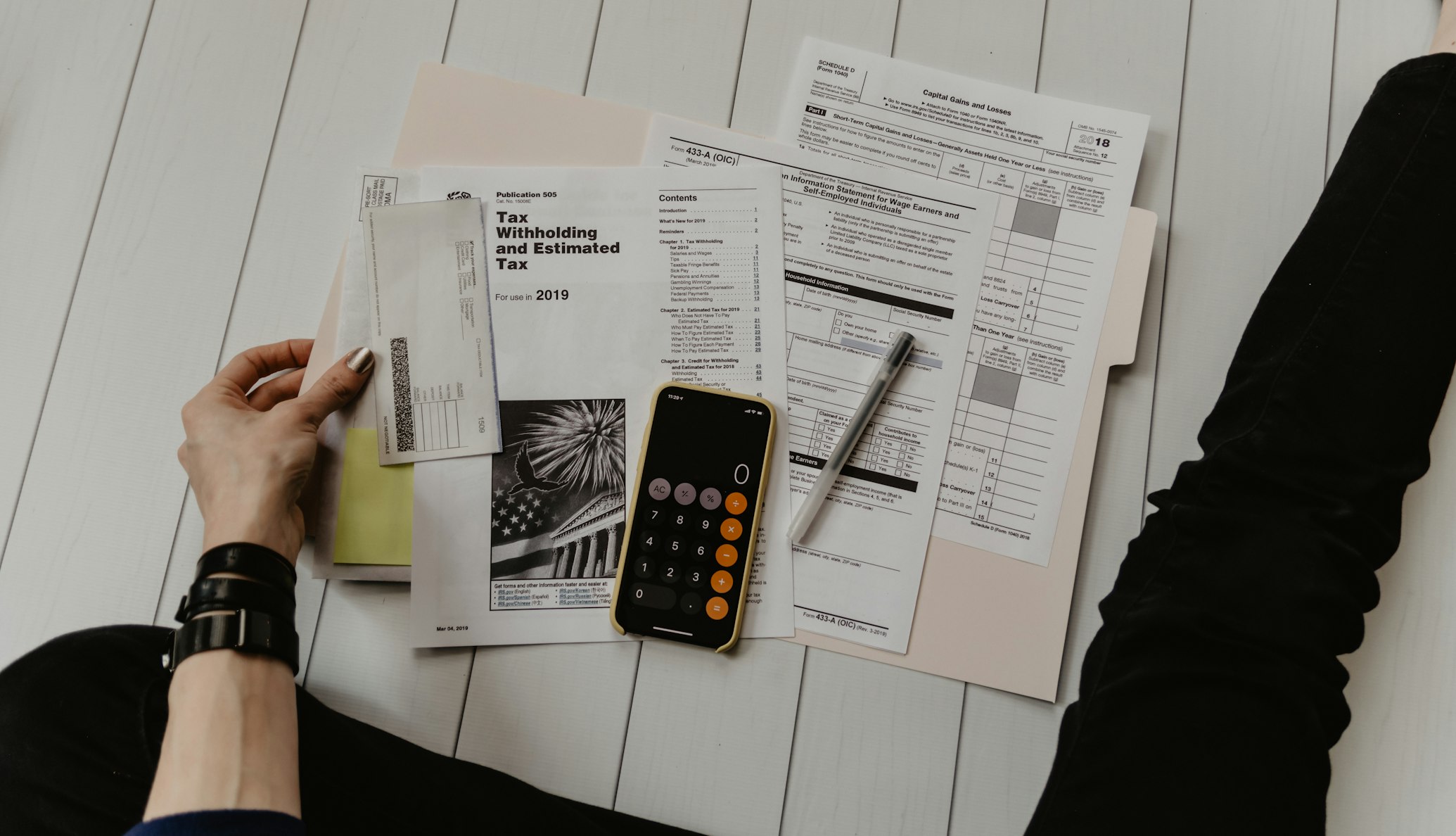

Revolutionize Debt Collection with Intelligent Voice Automation

Collect more with less effort with AI agents that talk, verify, and close payments 24/7. Smart, scalable, and regulation-ready, your next-gen automated debt collection solution

Leading the Future of AI Voice Bot for Debt Collection

Smarter Recovery, Lower Costs, Full Compliance. Automate every stage of collections with CollectDebt voicebots built for FDCPA, Reg F, and TCPA compliance with real-time agent assist.

Omnichannel Communication

Connect with debtors via SMS, WhatsApp, email, phone, and chat. Reach customers where they are, 24/7, improving engagement and recovery rates.

AI Voice Bot Technology

Voice agents automate payment reminders, follow-ups, and settlements, reducing manual workload 75% and improving right-party contact rates by up to 7x.

Multi-Language Voicebot Support

Handle debt collection calls effortlessly in 12+ languages and regional dialects with CollectDebt.ai's AI Voicebot. Ensure clear, compliant, and empathetic communication.

Predictive Analytics & Personalization

Segment accounts, score repayment likelihood, and tailor approaches for every stage, preventative, delinquency, and legal escalation, maximizing recovery with empathy.

Compliance & Security

Built-in compliance with FDCPA, TCPA, SOC 2, and GDPR; every call, text, or email is monitored for regulatory adherence and data protection.

Intelligent Payment Negotiation

AI debt collection software automates recovery using an intelligent voice bot and adaptive AI debt negotiations, delivering faster debt recovery across industries.

Powerful Features Built for Modern Debt Collection

Comprehensive AI-powered solutions that transform your debt recovery process

AI-Powered Debt Collection Solutions for Every Industry

Empower your business with AI Collections Software that recovers debts faster, improves right-party contact rates, and maintains full regulatory compliance.

1. AI Debt Collection

Automate end-to-end debt recovery with human-like voice agents that negotiate payments intelligently, handle objections empathetically, and secure commitments across voice, SMS, email, and WhatsApp—achieving 7x higher engagement than traditional methods while ensuring FDCPA compliance.

2. Accounts Receivable

Streamline AR workflows with predictive analytics that identify high-risk accounts, prioritize collection efforts, and optimize payment strategies. Reduce DSO by 35%, automate payment reminders, and integrate seamlessly with your existing ERP, CRM, and accounting systems for real-time cash flow visibility.

3. Compliance Management

Built-in regulatory adherence with real-time monitoring ensures every interaction meets FDCPA, TCPA, HIPAA, and state-specific requirements. Automated audit trails, call recording, consent management, and dynamic script compliance protect your agency from violations while maintaining debtor trust and dignity.

4. End to End Automation

Reach debtors on their preferred channels with coordinated campaigns across voice calls, SMS, email, WhatsApp, and web portals. AI-driven optimization identifies the best time, frequency, and channel for each contact, boosting right-party contact rates threefold and improving payment-to-promise commitments by 40%.

Redefining Industry Standards with Intelligent Debt Conversations

Financial Services

Regional Banks, Financial Institutions, Fintech Challenger Banks

Powering the Next Generation of Automated Debt Collection with AI

Collection Agencies

500+

powered

Payment Rate Increase

40%

improvement

Cost Reduction

60%

savings

Compliance Rate

99.9%

accuracy

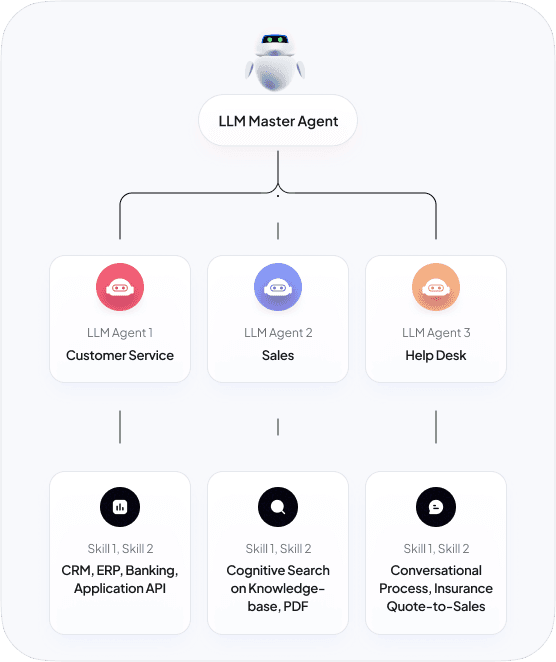

How the Debt Collection AI Agent Works

Automate recovery workflows with intelligent voice agents and omnichannel outreach strategies.

Sign up or connect your creditor account

For businesses / Enter portal for individuals

Get started by creating your account or connecting your existing creditor system to our platform.

AI analyzes account metadata and history

Preferred channels to initiate contact

Our AI examines account data, payment history, and communication preferences to determine the best approach.

Automated reminders and payment options

Personalized negotiation and payment plans

AI sends automated reminders and offers flexible payment plans tailored to each debtor's situation.

Monitor progress via dashboard

Escalate to human agent only if needed

Track collection progress in real-time and seamlessly escalate to human agents when necessary.

Celebrate debt-free progress

Update credit status and complete recovery

Successfully resolve debts and update credit status, celebrating the journey to financial freedom.

Affordable AI Debt Collection for Every Agency

Get flexible plans tailored to your business size, pay only for what you use, with AI Debt Collection Software built to grow with you.

Included Features:

For developing and launching your AI voice agent

- 1,000 calls/month

- Voice API, LLM, transcriber costs included

- Unlimited AI Agents

- API & Integrations

- Real-Time Call Monitoring & Human Transfer

- FDCPA compliance built-in

- Email support & Community access

Included Features:

Self-serve for agencies with moderate call volumes

- 5,000 calls/month, then $0.10/call

- 10 Concurrent Calls

- 2,000 Custom Workflows

- Everything in Starter

- Workflow Builder

- Team Access & User Management

- Priority support via Ticketing

- Advanced Analytics & Reporting

Included Features:

White label platform for agencies and resellers

- 15,000 calls/month, then $0.08/call

- 50 Concurrent Calls

- 10,000 Custom Workflows

- Unlimited Subaccounts

- White Label Platform

- 30-Day Onboarding & Private Slack Channel

- Priority support via Phone & Ticketing

- Custom Branding & Domain

Included Features:

For top-tier performance, scalability & support

- Custom pricing (volume-based), as low as $0.05/call

- SIP Trunk Integration

- Guaranteed Uptime (SLA)

- Custom Integrations

- 200+ Concurrent Calls

- Compliance (SOC2, HIPAA, GDPR)

- Dedicated Solution Architect

- 24/7 Phone Support

Frequently Asked Questions

CollectDebt.ai is an AI Debt Collection Platform that helps creditors and agencies automate recovery. It uses voicebots, automation, and analytics to boost right-party contact and improve collection rates.

Unlike other AI debt colllection software, CollectDebt.ai is built for compliance and performance. It delivers AI-driven, human-sounding conversations that recover payments faster and protect your brand.

Our AI Debt Collection Software follows FDCPA, Reg F, and TCPA rules. Every interaction is secure, recorded, and compliant by design.

Yes. It connects easily with QuickBooks, Yardi, Epic, Salesforce, and other CRMs for smooth data sync and real-time updates.

Yes. You can run a short pilot to see how our AI Collections Platform increases recovery and reduces costs before scaling.

Seamless Integration Across All Industries

Connect CollectDebt.ai's AI Voice bot effortlessly with your existing systems from EHR and RCM platforms in healthcare to QuickBooks, Xero, and banking CRMs in finance, Shopify and Lightspeed in retail, Yardi in real estate, and Oracle Utilities or SAP IS-U in telecom and energy.

view integrationsEnd-to-End Security Across Every Workflow

From voice calls to payment gateways, CollectDebt.ai ensures complete data protection through compliant, encrypted, and audited systems.

Redefine How You Connect, Collect, and Communicate

Collaborate with our team to implement the ideal AI Debt Collection Software tailored to your industry's specific needs.